Investments for the Future

- ESG Risk Management

- The scope of risk management continues to be expanded due to rapidly changing internal and external environments surrounding the financial industry, diversified customer demands, and increasing corporate social responsibilities. Shinhan Financial Group’s risk management efforts not only encompass traditional financial risks but also various others that can threaten the survival of a company such as natural disasters, industrial safety and health, and environmental pollution. To be specific, Shinhan Financial Group operates loans and investment policies in consideration of the Environmental, Social and Governance (ESG) issues for the sustainable development of corporates and industry and for the reputational risk management of the company. Also, we are responding to reinforced regulatory changes such as adoption of the Stewardship Code and reflecting EST related factors in its business operation process.

- Environmental Management

- Fulfilling the environmental responsibility poses both challenges and opportunities to a corporate from the longterm perspective along with global movements for reducing carbon emissions based on UN Climate Change Paris Agreement and reinforced environmental polices of the new government. Shinhan Financial Group has adopted an integrated green management system for systematic and efficient management of resources that are useful to its management activities. Also, we have built an eco-friendly business process, operated eco-friendly buildings, and adopted innovative technologies, effectively mitigating its impact on the environment. Meanwhile, we continue to preemptively reinforce monitoring and employee activities in order to respond to the constantly changing environmental polices and demands of external stakeholders.

Integrated ESG Risk Management

Shinhan Financial Group operates loan and investment policies in consideration of ESG issues to fulfill the social responsibility of a financial institution through sustainable finance and recognize risk factors related to the Environmental, Social and Governance (ESG) in determining its intent of loan and investment. To this end, we have introduced the Environmental & Social risk management policy framework (ESRM) and established the sector policy to designate and manage risky areas that are critical to the environment and society and create many issues and implemented the Environmental & Social risk review procedure (ESRP) for risk assessment and management of large-scale projects’ financing.

Designation and Management of Risky Areas

Shinhan has designated and managed areas and industries with huge social and environmental risks including GHG emissions, settlement violations and habitat destruction, industrial safety and health. By doing so, we have excluded areas that pose a negative impact on the environment and society significantly from our financial support and provided optional financing support for projects related to fossil fuel uses including climate change and fine dust. We have selected 12 risky areas based on the International Finance Corporation (IFC) guidance, excluded them from our financial support, and operated optional financing support as our policies.

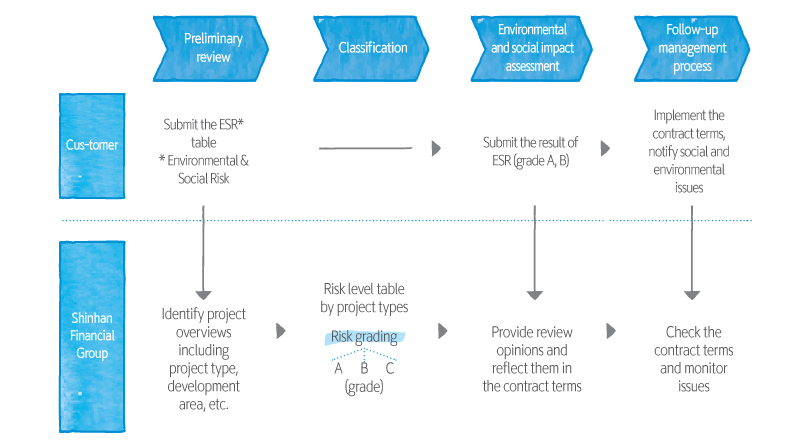

Environmental & Social Risk Review Procedure(ESRP)

As for project financing, we grade risk levels according to the social and environmental impact of the potential development project and reflect the result of ESRP in our investment decision. Also, we prohibit loans to unhealthy types of businesses such as manufacturers of unhealthy entertainment tools, adult entertainment bars, and loan shark establishments on principle, and any new applications must be approved by the loan review committee. We conduct a series of reviews such as target selection, risk level classification, environmental and social impact assessment based on the Equator Principles to evaluate environmental and social risks of the project.